What is a Screener?

Stock screeners allow you to identify investments which meet some given criteria. Put simply: stock screeners filter the market. One can be as strict or as liberal as they want with the criteria. A screener may even allow one to view the historical return of a given set of criteria. This process is known as “backtesting“.

The screener is the investing world’s equivalent of the vacuum or the dishwasher. It is one of those real game changers. When the vacuum came along, people stopped combing through their carpets for individual pieces of dirt, and nobody ever went back. Similarly, when the dishwasher came along people were liberated from having to wash dishes. Thank goodness. These tools are efficient and powerful, much like the screener. That being said, it is still important to remember to do our research. Just because a stock passes a screener doesn’t mean it is perfect.

The Yahoo Finance screener is likely the most accessible screener around. It has all that you need to get started. Another screener I have used in the past is the Globe and Mail Screener, which is especially useful for Canadian stocks. These are both good, accessible tools to get your foot in the door. Many more free screeners are available online with a quick google search.

It is understandable if you are uncomfortable setting the criteria yourself. The variety of options can be daunting. How do you know which criteria to use? Fortunately, these services sometimes offer “community screens” or, such as in the case of Yahoo Finance, have pre-built screens available. In the next section I show you two example screeners which demonstrate the various criteria used.

Backtesting & Example

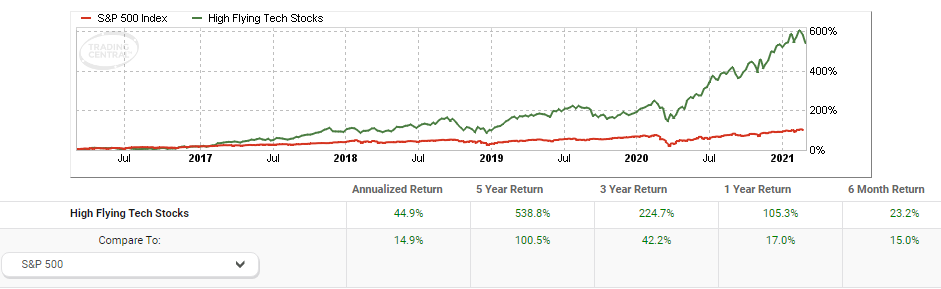

They say that the best predictor of future behavior is past behavior. This is sometimes true. Backtesting software allows us to evaluate how a strategy has performed over time. Unfortunately this is not usually a free feature. Perhaps the most economical way to start backtesting is with a TD Webbroker account. Frankly, this is the only backtesting software which I have used. It is great for most intents and purposes. Its main limitation is that it can only backtest five years into the past.

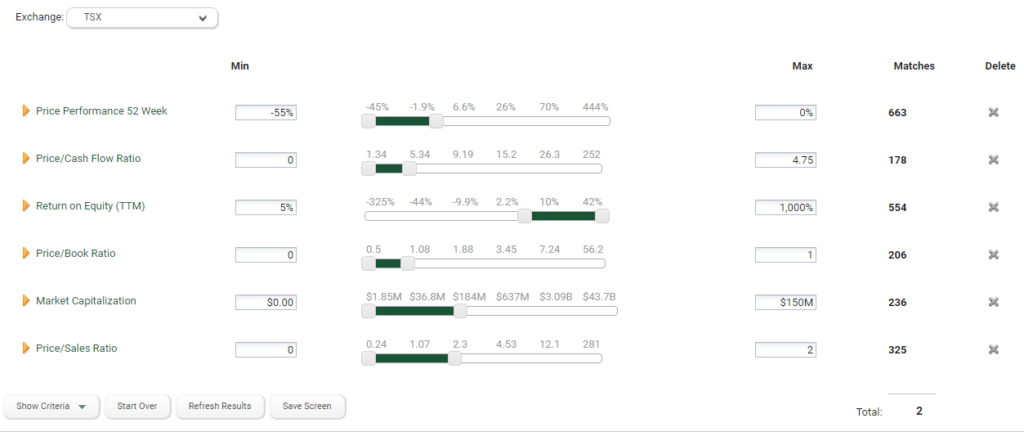

Below is an example of a screen which has performed fairly well in the past (see second image). These criteria would be classified as “value-investing” criteria, which is why I call this screener “Deep Value”. These criteria are all generally safe to include in your own screens.

What’s interesting is that this exact screener was able to identify Supremex (SXP.TO) a while back, which was a phenomenal opportunity at that time.

The above is an extremely stringent screen, meaning the criteria are extremely hard for most stocks to pass. This is the equivalent of a very fine filter. I would recommend being quite stringent with screens, perhaps narrowing it down to a list of five or ten. Too stringent and you can develop hyperfocus. Too lenient, and you are no better than where you started.

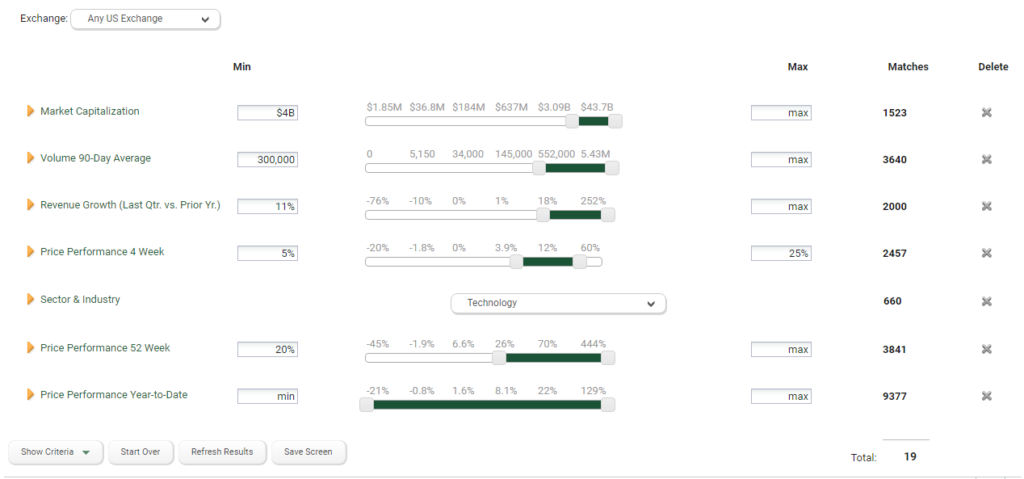

The “High flying technology stocks” screen, developed by the Globe and Mail, is representative of a “momentum” screener. These criteria could be used by someone looking to jump in on market fervor/euphoria. Screener beware: this type of strategy involves considerable risk.

To Conclude

The stock screener is another tool in the intelligent investor’s arsenal. By using a screener, we save valuable time we would have wasted looking at low quality stocks. Remember that the screener is not a replacement for more traditional research methods. Even if a stock passes a screener, further research should still be devoted to it before making a purchase. By using stock screeners, the intelligent investor can spend their time elsewhere. Leave the computers to what they are good at, so you can stick to what you are good at.

Of course, the best way to learn is by doing. That’s why I would recommend checking out some online screening tools for yourself.

It’s the best time to make some plans for the future and it’s time to be happy. I’ve read this post and if I could I wish to suggest you some interesting things or advice. Perhaps you can write next articles referring to this article. I want to read more things about it!